They diligently track influential news outlets such as Bloomberg, Reuters, and the Wall Street Journal, along with domestic news channels, meticulously sifting through information with the potential to influence specific sectors or companies. By discerning the underlying sentiment and motives conveyed through these sources, we strive to maintain a strategic advantage with our proven strategy.

Our daily analysis extends to news releases and announcements from companies featured in our clients’ portfolios or on our watchlist, evaluating their potential impact on stock prices and apprising clients of associated opportunities and risks.

Moreover, we establish privileged access to institutional valuations and ratings provided by industry titans that wield influence over approximately 80% of the market. These include institutions such as Morgan Stanley, UBS, Macquarie, Credit Suisse, Citi, JP Morgan, and Goldman Sachs.

This strategic approach keeps us ahead of any potential shifts that might impact our clients’ portfolios. For example, if several leading institutions downgrade a specific company on the same day, we swiftly analyse the situation, conduct thorough research, and guide our clients through potential implications.

In scenarios like these, clients can consider adjusting their positions and exploring more favorable opportunities. Moreover, we proactively identify stocks that major institutions endorse as solid buys, offering fresh perspectives and untapped possibilities. This distinctive advantage empowers our clients with a considerable competitive edge, enabling them to navigate risk adeptly while optimising returns.

Experience the pulse of daily global and domestic market dynamics, immersed in the latest updates on commodities, currencies, and company news. Our commitment extends to keeping you informed about daily changes on institutional ratings and valuations, offering insights that could impact the trajectory of your portfolio.

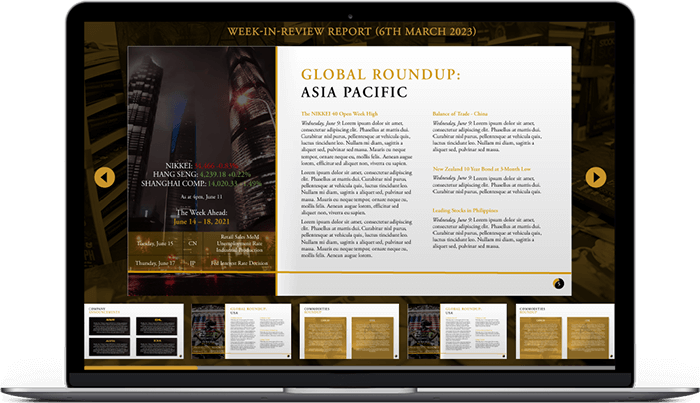

Uncover the essence of each trading week with our captivating Friday evening report. As the markets wind down for the weekend, our report springs to life, encapsulating the vibrant highlights of the week. Explore insights that unveil the heartbeat of the market, from macro and domestic news to the intricate dynamics of commodities and currencies. Venture deeper with sector analysis, explore pivotal company announcements, and gain a glimpse of the unfolding week ahead.

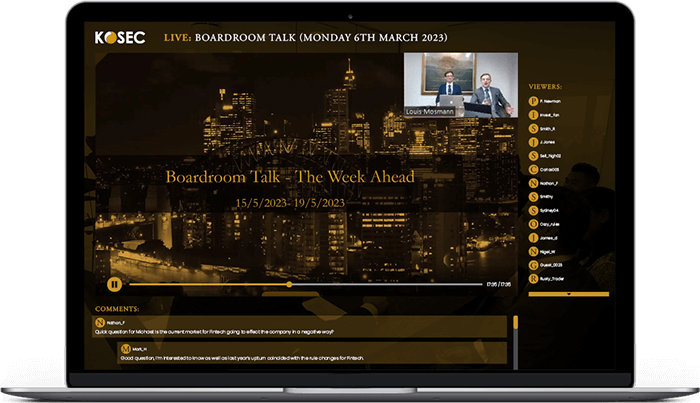

An exclusive live weekly webinar, led by our skilled research analysts. Immerse yourself in the world of macroeconomic events, stay updated on the latest market-shaping news and announcements, and unravel the complexities of commodity and currency trends. Acquire invaluable insights to navigate the upcoming weeks with confidence, all within a dynamic and engaging session that mirrors the experience of being in our boardrooms with us.

Moreover, we go the extra mile by meticulously assessing these companies, gauging their performance against consistent benchmarks of vital financial metrics: revenues, earnings, cash flow, operating margin, and ROE. Our evaluation extends to scrutinising their debt/equity ratio, affirming the sustainability of their debt. Beyond the numbers, we delve into their operational sector, scrutinise their product and service offerings, and evaluate the caliber of their management team. This thorough analysis equips us to not only manage risk effectively but also assign a strategic rating to each company.

As the lotus embodies knowledge, wisdom, and confidence, our software instills you with empowered decision-making. Lotus Blue meticulously pinpoints investment-grade companies within the All Ords index, prioritising profitability and return on equity (ROE). These selections are further refined, earning ratings that mirror their financial consistency, excellence in product/service, and the strength of their management teams. Originating as an internal tool for our fund management, we’ve now handed over the reins to you. Seize control and fine-tune your stock selection through filters that consider crucial parameters, encompassing sector, risk, valuation, and technical indicators.

Experience the privilege of direct and exclusive access to our team of highly qualified research analysts, ready to engage with you on any company or market-related news. Your insights, questions, and curiosities will find the attention they deserve with our expert team by your side. Elevate your investment decisions with firsthand input and expert analysis designed to inspire unwavering confidence in every move you make.

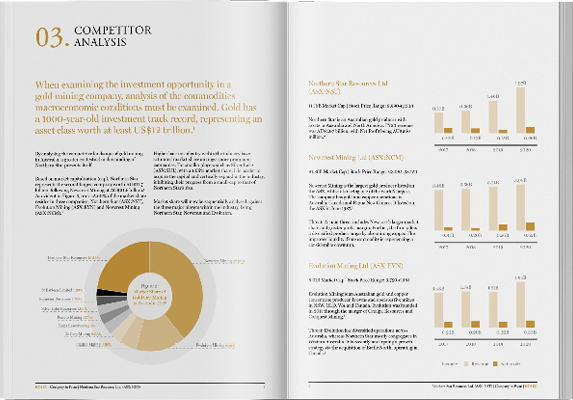

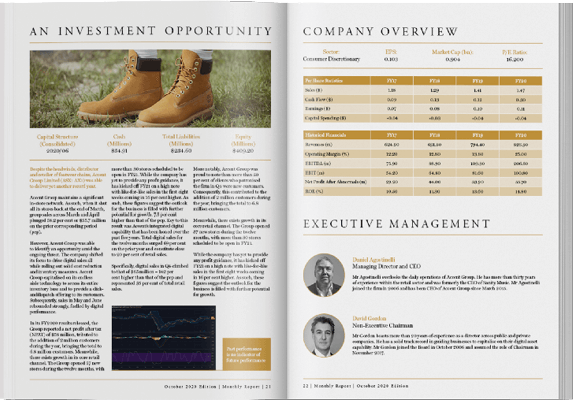

Delve into the depths of our comprehensive report, a meticulous exploration of the finest-performing companies. With a discerning eye, we dissect their financials, product and service offerings, intricacies of market positioning, the brilliance of their executive teams, and illuminate any potential risks that lie beneath. This report is your gateway to understanding the very fabric of these companies and the opportunities they hold.

Experience a monthly expedition through our publication, where we delve into the world of macroeconomic news spanning the US, China, Europe, and Australia. Within its carefully curated content, you’ll discover insights into pivotal events and announcements as well as unlocking a treasure trove of eight investment-grade opportunities.

Dive into our concise research that delves into the world of top-performing companies. Explore in-depth discussions about their latest developments, empowering you with the insights needed to identify potential investment opportunities with confidence.

In a landscape where these major institutions command around 80% of the market, their evaluations offer indispensable perspectives that aid us in risk mitigation. Yet, we’re not content with surface-level analysis of their ratings and valuations. Our approach extends to scrutinising price dynamics, verifying impartiality in their judgments. We go the extra mile by delving into the rationale behind each institution’s assessments, enriching our understanding of individual companies and refining our insights.

Unveiling such coveted insights remains a pursuit of both institutional and sophisticated investors, yet access remains beyond reach. Our game-changing strategy pivots on selecting companies endorsed by a dominant wave of buy ratings, accompanied by valuations exceeding prevailing stock prices—an approach that casts an additional layer of armor against risk.

An unparalleled software, a game-changer that’s reshaping the landscape. Unveil a world of decision-driving data: from the freshest macroeconomic insights to currency and commodities forecasts, laser-focused sector analysis, insider trading intel, company-specific updates, fundamental analysis, institutional valuations, analyst ratings, broker consensus, thematic stocks, unparalleled insights, dynamic charting tools, and the force of Artificial Intelligence.

Unveiling a valuation model that transcends conventional norms, our approach employs an expansive array of metrics that far surpasses the confines of the P/B-ROE Model, Residual Income Model, and Discounted Cash Flow (DCF) Model. Our conviction lies in the belief that this all-encompassing methodology begets valuations of unparalleled precision and dependability. By honing in on companies boasting valuations positioned beneath their current stock prices, we not only refine our investment decisions but also fortify our risk mitigation strategies.

Inspired by Warren Buffet’s remarkable ability to uncover hidden gems in the stock market, our journey began with the visionary leadership of our Founder, Michael Kodari. His goal was nothing short of elevating valuation methodologies to a new level of precision. To bring this vision to life, Michael collaborated with a team of brilliant mathematicians and data scientists, affiliated with the esteemed Fields Institute of Mathematics in Canada—a Nobel Prize-winning institution.

This innovation took shape through meticulous back-testing of major valuation models, resulting in the creation of a more robust and powerful intrinsic company valuation model. What sets us apart is our commitment to a comprehensive integration of a diverse range of financial metrics, a departure from conventional models. This holistic approach optimizes accuracy, giving our valuation model an unparalleled foundation of solidity and precision. Join us on this exciting journey where innovation meets precision, and your investment decisions are guided by the expertise of the best in the field.

Staying poised for a potential market rebound often carries hidden costs, and it’s a pitfall many investors stumble into, often overlooking the reality that sound business fundamentals don’t necessarily guarantee an uptick in stock prices. The link isn’t direct; however, we insert an additional layer of risk mitigation to potentially steer clear of adverse news and instead focus on companies favored by major institutions and analysts.

Our daily scanning ritual revolves around meticulously analysing around 200 companies that meet our stringent filtering criteria. We dive into price action intricacies, uncovering the rhythm of market structure, deciphering order blocks, market depth, volume, institutional footprint, pinpointing supply and demand zones, tracing the contours of significant support and resistance levels, unraveling chart patterns, and decoding price movement in pivotal areas. This orchestration not only identifies possible opportunities but also sets the stage for more in-depth due diligence.

Our dedication lies in presenting opportunities characterised by a favorable risk-to-reward ratio. This is achieved through meticulous planning of our exit strategy before entry and strategically positioning stop-loss orders. This approach effectively manages risks and optimises returns. We seamlessly integrate our proprietary in-house indicators with other technical benchmarks, aiming for the perfect blend of confluence and confidence before spotlighting an opportunity.

After our daily investment meetings, our team of experts will personally connect with you to discuss compelling opportunities and provide you with relevant insights. Additionally, they will send you an email that outlines these opportunities, along with the analysis and reasoning behind them, ensuring transparency in our process.

Our team of traders and dealers is available daily to engage with clients regarding macroeconomic news, company announcements, institutional ratings, valuation changes, or analyzing the chart of any stock. We have a dedicated group of professionals committed to providing further insights and assistance, addressing any inquiries you may have.

Receive an email immediately following our daily investment meeting, providing you with a comprehensive breakdown of our top-down reasoning. Delve into the intricate details of a time-sensitive buying opportunity backed by meticulous research. This exclusive communication brings you closer to the heart of our strategic decision-making process, enhancing your investment journey.

At the pinnacle of our technological arsenal lies our sophisticated software, driven by machine learning algorithms that elevate our investment decision-making during pivotal meetings by dissecting real-time data and surveying the dynamic market landscape. This technological marvel empowers us to sift through the vast expanse, isolating low-risk prospects while perpetually gauging market conditions. Notably, our vigilant investment team promptly receives alerts about potential pitfalls within our clients’ portfolios, providing the leverage to promptly swap them for alluring, low-risk alternatives – a strategic safeguard for capital preservation.

Chifley Tower, 2 Chifley Square,

Sydney NSW 2000

1300 854 151

© 2025 KOSEC | Kodari Securities Pty Ltd | ABN 90 147 963 755 | FSG | Terms & Conditions | Disclaimer & Legal

© 2025 KOSEC | Kodari Securities Pty Ltd

ABN 90 147 963 755

KOSEC - Kodari Securities does not provide any investment advice, nor is anything mentioned an offer to sell, or a solicitation of an offer to buy any security or other instrument. Anything discussed is for informational purposes only and does not address the circumstances or needs of any particular individual or entity. Investing in the stock market is high risk. Under no circumstances should investments be based solely on the information provided. We do not guarantee the security or completeness of information on this website and are not held liable. Kodari Securities PTY Ltd trading as KOSEC is a corporate authorized representative (AFSL no.246638) which is regulated by the Australian securities and investment commission (ASIC).